Developer Contributions SPD

(7) Purpose of this Document

The Warwick District Local Plan (adopted September 2017), sets out the planning policies for the growth and, in places, regeneration of the District to 2029. It specifies a significant amount of growth for the district in terms of new homes required and development needed to provide economic growth and related employment opportunities. Given the amount of growth identified, this SPD will be an important document which sets out how the Council will secure developer contributions from eligible development. This will be an essential requirement in order to assist in the delivery of new and improved infrastructure that our communities require and to ensure that the planned growth is sustainable.

When determining a planning application, Local Planning Authorities (LPA's) consider the need to apply specific conditions, restrictions, activities, operations and contributions, necessary to make the development acceptable in planning terms. These are referred to as 'planning obligations' (also referred to as developer contributions).

The purpose of this Developer Contributions Supplementary Planning Document (SPD) is to provide clarity regarding Warwick District Councils approach to seeking developer contributions that are necessary to provide the physical, social and green infrastructure to support high quality development outcomes and sustainable planning objectives.

This SPD will explain: -

- How developer contributions will be secured (including the policy basis and procedures, types of contributions, methodology of calculation, timing and process of collection);

- Clarifies the relationship between planning conditions, planning obligations and the Warwick District Council Community Infrastructure Levy (CIL);

- Provides a mechanism to help ensure the timely provision of infrastructure to support growth:

This SPD comprises two parts:

Part One sets out Warwick Districts overall approach to securing planning obligations. In addition, it explains how the SPD complies with national and local policy, and deals with procedural matters relating to the drafting and enforcement of Section 106 matters.

Part Two sets out the types of obligation that the Councils may seek to secure from development. It also identifies the relevant policy basis, types of development to which the obligation may apply, thresholds over which the obligation may be sought and, where possible the basis on which the level of the obligation will be calculated.

The SPD will also provide prospective developers with clarity on the relationship between the various methods utilised to secure contributions. These include Section 106 planning obligations (or Unilateral Undertakings), Section 278 agreements under the Highways Act 1980 and the use of planning conditions. The document will also explain the relationship between the aforementioned and charges made on development associated with the Councils adopted Community Infrastructure Levy (CIL). This SPD will outline details of some of the key contributions often required and signpost potential developers to detailed advice that may be available with regard to specific infrastructure requirements.

The SPD will also include a series of issue specific S106 templates in order to try and regularise and expedite the efficient production of consistent legal agreements.

In the determination of planning applications for new development Warwick District Council must take into account a wide range of considerations required to ensure the acceptability of a proposal. One of these considerations is whether the development would generate a need for new or improved infrastructure, services or facilities, without which the development would be unacceptable in planning terms.

Local authorities must therefore ensure that such infrastructure needs are addressed and that new development is deemed acceptable. These developer contributions may, in some instances, be delivered directly by the developer, or by way of a financial contribution to the Council for it to arrange for the necessary investment to be made.

Legislative Context

National Planning policy context

The National Planning Policy Framework (NPPF) identifies that local planning authorities should consider whether otherwise unacceptable development could be made acceptable through the use of conditions or planning obligations. It highlights that planning obligations should only be used where it is not possible to address unacceptable impacts through a planning condition (NPPF paragraph 54).

The NPPF (paragraph 56) restates the three statutory tests for planning obligations which are defined in the CIL Regulations and identifies that where obligations are being sought or revised, local planning should take account of changes in market conditions over time and, where appropriate, be sufficiently flexible to prevent development from being stalled (paragraph 57).

Section 106 of the Town and Country Planning Act 1990 (as amended) provides the mechanism for planning obligations to be secured from development. In addition, The Community Infrastructure Levy (CIL) Regulations 2010 (as amended) sets out additional legislation on the use of planning obligations.

Regulation 122(2) of the CIL Regulations defines that for a planning obligation to be taken into consideration when granting planning permission, it must be:

- Necessary to make the development acceptable in planning terms;

- Directly related to the development; and

- Fairly and reasonably related in scale and kind to the development

Regulation 123 of the CIL Regulations placed limitations on the pooling of planning obligations whereby no more than five separate planning obligations could be entered into to enable the funding or provision of a single infrastructure project. It is important to note that as of the 1st September 2019 new legislation (The Community Infrastructure Levy (Amendment) (England)) (No2) Regulations will have removed the pooling restriction's. Council's now have the flexibility to utilise multiple Section 106 contributions to fund a single infrastructure project (if necessary/ desirable) or to utilise S106 and CIL generated income for the same purpose (previously this was not permitted).

In relation to viability, NPPF paragraphs 34, 56 and 57 make it clear that development should not be subject to such a scale of obligations and policy burdens, that the viability of the scheme is threatened. It also identifies that authorities should assess the likely cumulative impact on development viability of all existing and proposed local standards and policies when taken together with national requirements, and that this cumulative impact should not put implementation of the plan at risk and should facilitate development throughout the economic cycle / plan period.

The emphasis on deliverability has further been strengthened by provisions within the Growth and Infrastructure Act 2013 which enable developers to apply to the local planning authority to modify affordable housing requirements set out in section 106 agreements where the requirements would make the development economically unviable.

National Planning Guidance (PPG) states that obligations must be fully justified and evidenced, and where affordable housing contributions are being sought, obligations should not prevent development from progressing. It also highlights that where local planning authorities require affordable housing obligations or tariff style contributions to infrastructure they should be flexible in their requirements and policies should be clear that such obligations will take into account specific circumstances.

It should be noted that National PPG identifies that in order to prevent overburdening small development schemes, contributions for affordable housing and tariff style obligations should not be sought from developments comprising 9 dwellings or less, and which have a maximum combined floor space of 1,000 square meters or less.

Local Policy Context

Warwick District Council Local Plan 2011-2019

The Local Plan sets out the overarching development strategy for the District to 2029. It includes strategic policies, allocations and designations for the future change and growth of Warwick District. This plan also includes local policies for Development Management purposes.

https://www.warwickdc.gov.uk/info/20410/new_local_plan

Policy DM1, (Infrastructure Contributions) sets out the rationale for seeking developer contributions, whilst Policy DM2 (Assessing Viability) sets out the framework for the consideration of any viability concerns that may arise. (See appendix 1)

Other key planning policy documents include:

Supplementary Planning Documents (SPD's). SPD's expand upon and provide further detail to policies in Development Plan Documents.

https://www.warwickdc.gov.uk/info/20794/supplementary_planning_documents_and_other_guidance

The Infrastructure Delivery Plan

This is a live document adjusted over time and contains the physical, green and social infrastructure required to support development over the Local Plan period.

https://www.warwickdc.gov.uk/info/20376/planning_policy/1200/infrastructure_delivery_plan

It should also be noted that the Council's Local Development Scheme (LDS) sets out the intended programme for the preparation of key planning policy documents throughout the plan period. It should be consulted periodically as it will highlight when new SPD'S (that may influence developer contributions) will be emerging

https://www.warwickdc.gov.uk/downloads/file/5307/local_development_scheme_2019-20

Types of Developer Contributions

What are planning Obligations?

A planning obligation is secured by either a deed of agreement or a unilateral undertaking made under planning legislation (Section 106 of the Town and Country Planning Act 1980 (as amended) in association with a planning permission for new development. It is normally applied to aspects of development that cannot be controlled by imposing a planning condition or by the use of other statutory controls.

Planning obligations are legally binding and enforceable if planning permission is granted. The obligations remain with the title holder of the land in question. They can cover almost any relevant issue such as the provision and funding of types of infrastructure or services and future maintenance.

Planning obligations should only be used where it is not possible to address the unacceptable impact of development through a planning condition (NPPF, paragraph 54).

In addition, CIL Regulation 122 states that the use of planning obligations should only be sought where they meet all of the following three tests:

- They are necessary to make a development acceptable in planning terms

- They are directly related to a development

- They are fairly and reasonably related in scale and kind to the development

Planning obligations are linked to the land within the planning application, rather than the person or organisation that develops the land. It is, therefore, recorded as a land charge, and obligations under it run with the land ownership until they are fully complied with.

What is Community Infrastructure Levy (CIL)?

CIL is a levy which allows local authorities to fund infrastructure by charging on new development in their area, CIL contributions raised will go towards the costs of infrastructure. Warwick District Council (WDC) completed the necessary consultation exercises and underwent a successful CIL Inspection: CIL has now been formally adopted by the Council with effect from 18th December 2017. Once adopted CIL is fixed, non-negotiable and enforceable.

The principle is that all eligible developments must pay the CIL charge, alongside any S106 planning obligations; the CIL charging rates are based on viability testing, and an identified need for infrastructure. The process for securing CIL payments is set out in the Charging Schedule and is summarised in the table below. Further information can be found on the Council's website and in the CIL element of the National Planning Practice Guidance.

Figure 1.

Community Infrastructure Levy (CIL) Process Overview table:

|

STEPS |

COMMUNITY INFRASTRUCTURE LEVY |

|

1 |

Alongside Planning Application, applicant / agent completes and submits a 'determining whether a development may be CIL liable form' including the relevant floorspace and development type details. An Assumption of Liability Notice should be included with the application. |

|

2 |

The Council will determine the levy based on the current CIL Charging Schedule. |

|

3 |

Once in receipt of the relevant forms WDC produces a draft Liability Notice, in consultation with the Agent / Applicant to ensure details are correct before being issued. |

|

4 |

When planning permission is granted and an Assumption of Liability form has been received, a Liability Notice will be issued and the Levy rate will be registered. |

|

5 |

Where a party wishes to apply for relief / exemption from the CIL levy, they are required to submit the relevant CIL relief / exemption forms to the Council prior to the commencement of development. Relief / exemptions will be considered and where they are granted Liability Notices will reflect this. No development can be 'self-assessed', all potential exemptions must be applied for and granted by WDC. |

|

6 |

Liable party is required to submits a Commencement Notice prior to any works starting on site. |

|

7 |

Once an Assumption of Liability Notice and Commencement Notice have been received, a Demand Notice/s will be issued (if relevant) to the person/s liable to pay the CIL in accordance with the CIL Payment Instalments policy. Where a Commencement Notice is not submitted the payment will be due in full on the presumed commencement date. |

|

8 |

On final payment of the outstanding CIL charge, the Council Land Charges Section will remove the CIL liable amount from the Land Charges Register. |

The CIL Charging Schedule that sets out the financial requirements with regard to particular land uses can be viewed at: -

https://www.warwickdc.gov.uk/downloads/file/4740/cil_charging_schedule_final

WDC is responsible for collecting CIL monies due. A proportion of the money collected is distributed to Town and Parish councils in which developments fall; 15% - 25% of the total amount received dependant on whether a Neighbourhood Plan has been adopted. This proportion must be spent to support the impact of developments on local communities.

It is not intended that CIL replaces S106 agreements. S106 agreements will be used alongside CIL to secure infrastructure requirements. S106 infrastructure may be physically off-site, but must be clearly linked to the development site and needed to make the development acceptable in planning terms. Unlike funding from S106, CIL funds can be spent on a wide range of infrastructure to support development without the need for a direct geographical or functional relationship with the development.

The relationship between CIL and Section 106

CIL monies are intended to provide for infrastructure support rather than specifically to make development proposals acceptable in planning terms. Government guidance specifies that site specific mitigation will still be sought through the use of planning obligations.

Planning Conditions

Planning conditions cannot require the transfer of land ownership or the payment of monies. They are attached to planning permission and set out details or required standards, timeframes and works which must be carried out at prescribed stages in the development process. They may also require further details to be submitted in order to make a proposal acceptable.

The NPPF paragraph 55 states that planning conditions should only be attached to a planning permission where they are necessary, relevant to planning and to the development to be permitted, enforceable, precise and reasonable in all other respects.

Where there is a choice between imposing planning conditions and entering into a planning obligation to manage the impacts of a new development, the use of planning conditions is always preferable.

However, planning conditions;

- Cannot be used to secure financial contributions

- Cannot be used in relation to land outside the application site; and

- Can be appealed by the applicant if they believe them to be unreasonable

Where the above restrictions cause an issue in appropriately mitigating the impact of development; the LPA may use a planning obligation.

Section 278 Agreements

Where a development requires works to be carried out on the existing adopted highway, an Agreement will need to be completed between the developer and Warwickshire County Council under Section 278 of the Highways Act 1980. Examples of such works could be the construction of new access/ junction improvement of the highways/ junctions, or safety related works such as traffic calming or improved facilities for pedestrians and cyclists.

Figure 2.

Summary of Planning Mechanisms used for mitigation against the impacts of development

|

MECHANISM |

DETAILS |

EXAMPLE USES |

|

Planning Conditions |

To make otherwise unacceptable development permissible – these may restrict the use of development, or require specific, approval via a discharge of condition prior to commencement |

Noise and odours Landscaping Materials Working Hours |

|

S106 Planning Obligations |

To make otherwise unacceptable development permissible by imposing controls that cannot be secured by planning conditions. These may be financial or non-financial and provided on or off site. |

Provide affordable housing Address site specific impacts Deliver essential Infrastructure |

|

S278 Highways Agreements |

Agreements to provide for alterations to the adopted highway to be funded by developers |

Highway Improvements |

(11) Procedures/ Process

General approach

It is the purpose of this SPD, once adopted to give developers guidance of the scope of developer contributions that they will have to consider as part of their intended development process. In many instances this will embrace contributions towards CIL, S106 and or S278 agreements.

Albeit that previous pooling restrictions did, in some instances, curtail the use of planning obligations it is expected that in many instances (where appropriate) planning obligations will still be sought for infrastructure matters related to the following: -

- Affordable Housing

- Air Quality Initiatives

- Outdoor Sports Facilities/ Playing pitches

- Indoor Sports Facilities

- Health Infrastructure – Local GP Surgeries / health centres and Hospitals

- Community Safety / Policing

- Biodiversity Offsetting

- Open space and Green Infrastructure

- Sustainable Drainage Systems (SuDS)

- Education

- Highways and Transport

- Local Labour Agreements

- Libraries

- Community Halls

- Other Infrastructure which is required to mitigate the direct impact of a development.

It should, however, be noted that this is a general guide and development proposals will continue to be assessed on a case by case basis with the individual circumstances of each site being taken into consideration when identifying infrastructure requirements.

Planning Obligations

The Local Planning Authority (LPA) will assess each application to determine if a planning obligation is needed and if so what it should address. It will do this in consultation with other public bodies responsible for infrastructure provision. Warwickshire County Council, for example, is a major provider of services and infrastructure.

The LPA, and other key agencies, will use planning obligations to:

- Secure general planning requirements that are necessary to allow the development to be permitted and where this cannot be achieved by way of planning conditions;

- Ensure that there is satisfactory infrastructure to allow the development to proceed and that the infrastructure provided will be maintained: and

- Offset relevant adverse impacts, for example, on the environment, education, social, recreational and community facilities and transport that arise from the development where the impact might otherwise have been refused because of those adverse impacts.

Process

Pre-Application Discussions

As part of any pre-application discussions the LPA will seek to agree the requirements and Heads of Terms for any planning obligation.

It is the Council's strong preference, where applications and associated planning obligations are more complex, that negotiations occur, and agreement on Heads of Terms is achieved, prior to the submission of a planning application. Pre-application discussions can help to resolve potential problems and issues which may otherwise delay the determination of a planning application.

It is recommended in the Council's Validation List that draft Heads of Terms accompany any application that requires a planning obligation. Indeed, the Local Validation list will be a useful starting point to shape/ identify the range of issues / infrastructure that a development is likely to need to consider and address.

The Council's Local Validation List can be seen at: -

https://www.warwickdc.gov.uk/downloads/file/4958/local_validation_list_-_adopted_may_2018

Unilateral Undertakings

In cases where a planning obligation is only dealing with financial contributions the LPA will encourage developers to make a unilateral undertaking and to make the relevant contributions on the granting of planning permission and / or at different stages of the development.

Cross Boundary Applications

Where a planning application site falls partly in another local planning authority area the Council will, as far as possible, work to coordinate proportionate planning obligation requirements with that authority. If, however, agreement cannot be reached, the Council will seek obligations for the portion of the site that falls within Warwick District.

Viability

The Council will seek to secure a fair and reasonable developer contribution without adversely affecting the ability for new development to take place across the District. Paragraph 57 of the NPPF emphasises the need for consideration of viability and costs in plan making and decision taking processes. It is recognised that some development proposals may be unable to meet all of the relevant policy and planning obligation requirements while remaining economically viable and deliverable, either in whole or part.

As the Council recognises the wider benefits of development to the District in terms of the associated outputs from the development such as regeneration or helping meet housing need then, in such circumstances the Council will consider a request from the developer, applicant, or landowner to reduce the level of planning obligations on the basis that it is not financial viable to provide or pay (whether in part or full) any Section 106 planning obligation requirements or charges deemed necessary and appropriate.

Such requests must clearly demonstrate to the Council what the developer, applicant or landowner is prepared to fund in terms of planning obligations, the reasons why the development cannot support the full planning obligation requirements (such as high abnormal costs), including comprehensive evidence which must include an Economic Viability Assessment (EVA) in order for the Council to take it into account as a material consideration.

The assessment should be submitted, if possible, at the pre-application stage of the planning process to enable the request to be considered and verified by the Council.

EVA's should be accompanied by a detailed explanatory statement which clearly shows the residual value of the land and therefore the price payable is not sufficient to incentivise the landowner to release the land for the proposed development and would otherwise hold the land undeveloped until a time where their incentivised price could be reached.

Developers will be required to work on a fully 'open book' basis and the EVA must contain prices, costs and assumptions that reflect the proposed development including anticipated sales prices supported by comparable market evidence and costs supported by tendered quotations or BCIS data.

All viability submissions will be carefully considered by the Council. Once submitted the Council's professional advisors will review the information provided to support a reduction in the required planning obligations to initially determine if sufficient information has been provided to support the request. Following this the Council's advisors will carry out an independent appraisal of the site to determine if acceptable development would be viable which would bring forward development of the site.

The land value and the developer's return elements of the appraisal will be determined as to what is sufficient to incentivise both parties to sell and develop the scheme. These will broadly be reflective of the returns currently being sought and accepted within the market, including any adjustment to account for the market risk of the scheme. Developers return will typically range between 17.5% and 22.5%.

The Council will not take into account the price paid or agreed by the applicant for the land whilst reviewing the viability assessment, but will consider what a reasonable land value would be which is sufficient to incentivise the land owner to sell or develop for the proposed scheme based upon a number of factors including case law, market conditions and guidance.

Negotiation of reduced contributions

The Council is under no obligation to accept a reduction in the required level of planning obligations and may ultimately refuse the planning obligation if the applicant will not provide these. If it can be demonstrated that a scheme is unable to fund the required section 106 contributions and this is accepted by the Council, then the Council will consider the cumulative benefit of the scheme. The Council will also consider how the need for required obligations can/may be met from an alternative source than the developer with a view of negotiating a reduced requirement from the scheme.

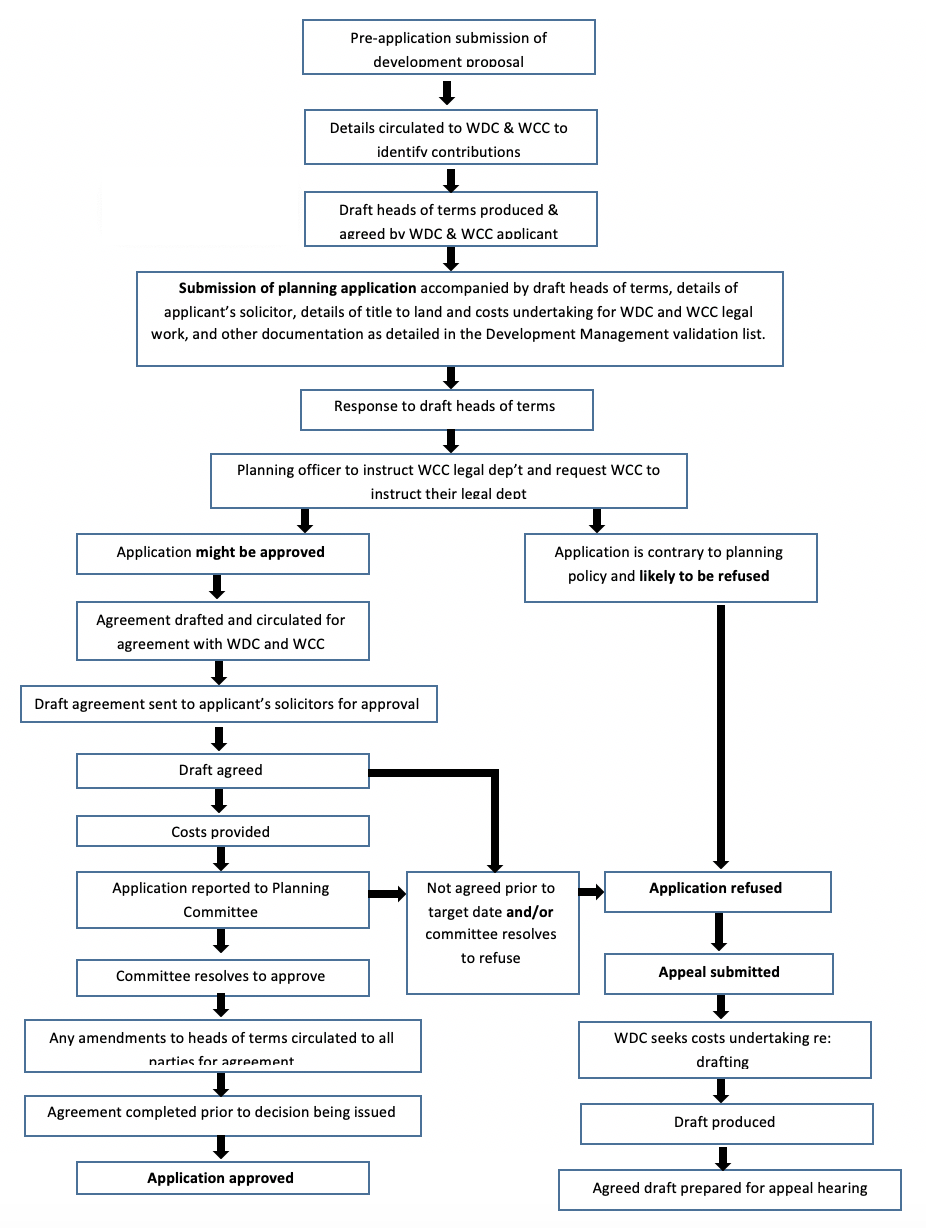

Figure 3

Development Contributions – The Section 106 Process

Securing Timing of Payments/ Fees

Financial contributions (apart from legal costs, which are usually paid prior to the completion of the agreement), and standard administration charges will need to be paid prior to the implementation of planning permission or in accordance with a programme of agreed stage payments.

Prior to the making of a Planning Obligation, the developer should note the financial contributions payable and the corresponding triggers or payment dates as specified in the agreement.

The developer should notify the Council, or County Council if relevant of a trigger point being reached and their intention to pay the financial contribution. When a trigger point has been reached the Council will calculate the total financial contribution payable and will provide a copy of this calculation to the developer. Once the developer has agreed the calculation the Council will issue an invoice to the developer for the agreed sum. The Council will not accept payment of any financial contribution unless accompanied by a valid invoice. The Council will, if necessary charge interest on late payment in line with the terms set in the agreement.

Upon receipt, financial contributions will be held in a specific account before being transferred to the relevant internal departments or third parties (e.g. other public sector bodies, parish council etc.) responsible for spending the contribution. The District Council will work with the County Council to expedite the transfer of monies to other agencies quickly and efficiently.

The Section 106 agreement will include a clause detailing how and when any unspent funds will be refunded. Given that a unilateral undertaking, necessarily, does not have the Council as a party, there cannot be any obligations on the Council to return any unspent monies.

All receipts and spending of financial contributions and the discharge of Section 106 obligations will be recorded and monitored by the Council. This will be achieved by the publication of a quarterly monitoring report as well as the Council's annual Infrastructure Funding Statement.

Please note that financial contributions paid to Warwickshire County Council (i.e. those relating to highways and education and relevant administration and monitoring fees) will be subject to a different process and developers are advised to refer to WCC's guidelines or contact the WCC Infrastructure Team at: - infrastructureteam@warwickshire.gov.uk for further information.

Fees

The Council's legal costs of preparing a Planning Obligation will be borne by the developer. These costs will be based on an hourly rate and will depend on the complexity of the agreement and the length of time taken to settle the draft and proceed to completion. The Council will therefore require developers to provide a 'cost undertaking' to pay for the Council's reasonable fees, prior to it being able to instruct its acting solicitors. It should be noted, that the Council's reasonable fees will need to be met even if the planning obligation is not completed.

Standard unilateral undertakings will be subject to an administration charge covering legal costs and if necessary the transfer of money to third parties.

Monitoring and Enforcement

The Council monitors all planning obligations and will work with developers to ensure that financial contributions and non-financial obligations are delivered on-time. Monitoring fees will be charged in order to undertake such work. The monitoring fee will be derived using a formula that considers the complexity of the agreement (the number of obligations in a particular agreement), the number of officer hours required the monitoring officer's salary rate and the number of years it is estimated that monitoring will be required for a particular development.

Monitoring activities will include: -

- the request, management and distribution of financial contributions and other obligations associated with the deed;

- monitoring on-line systems for planning officers, managers and the public domain;

- checking recording and updating each trigger-point (timing requirement);

- physical monitoring of the development site (site visits)

The monitoring fee (and its calculation) will be stipulated in each agreement. The monitoring fees formula is shown in full in the template S106 document (Appendix 3 of this SPD).

Enforcement

Where there is evidence of non-compliance with a Planning Obligation (such as the non-payment of financial contributions, failure to comply with an obligation, or failure to notify the Council of a due payment or event as required), the Council will seek to recover all reasonable administration costs incurred. This could include, for example, site visits, the recovery of any unpaid monies and / or correspondence.

If it is clear that matters within the planning obligation are not being complied with, the Councils Legal Team may be instructed to take appropriate action to secure compliance. This could include for example, seeking a court injunction.

Indexation

Contributions are based upon the costs of infrastructure. Financial contributions will therefore be indexed (i.e. index –linked to inflation) to ensure that they retain their 'original' real value. The base date and appropriate index to be applied will be set out in the legal agreement.

Where a formula has been set for the calculation of contribution levels (e.g. contractor rates), any cost figures will be updated periodically to take account of inflation and are the sums required at the time of negotiation.

All payment levels will be subject to an inflation factor adjusted according to the fluctuations between the date of the obligation and the quarter period in which payment is due to the District Council, the County Council will also adjust payments to it but these may be subject to different measures of inflation.